Seasteading tech for ten thousand startup countries our best chance for liberty

The Seasteads are Here

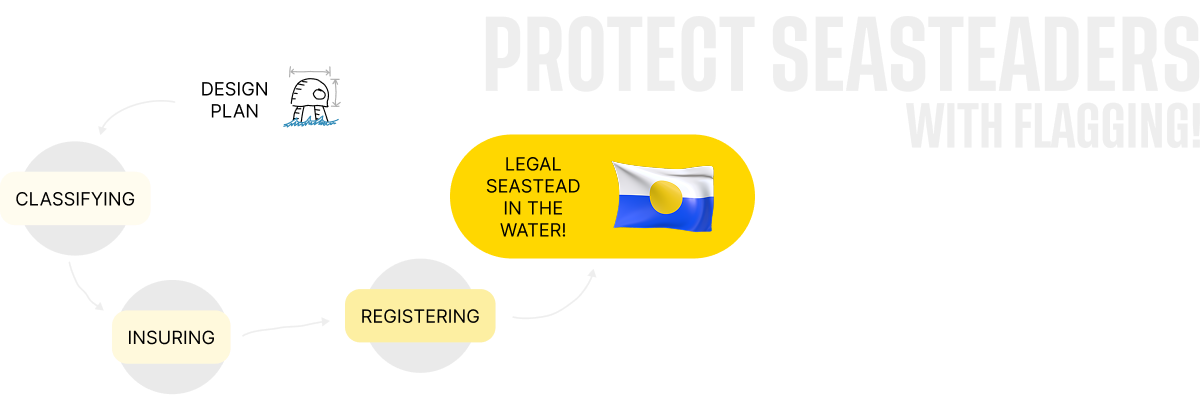

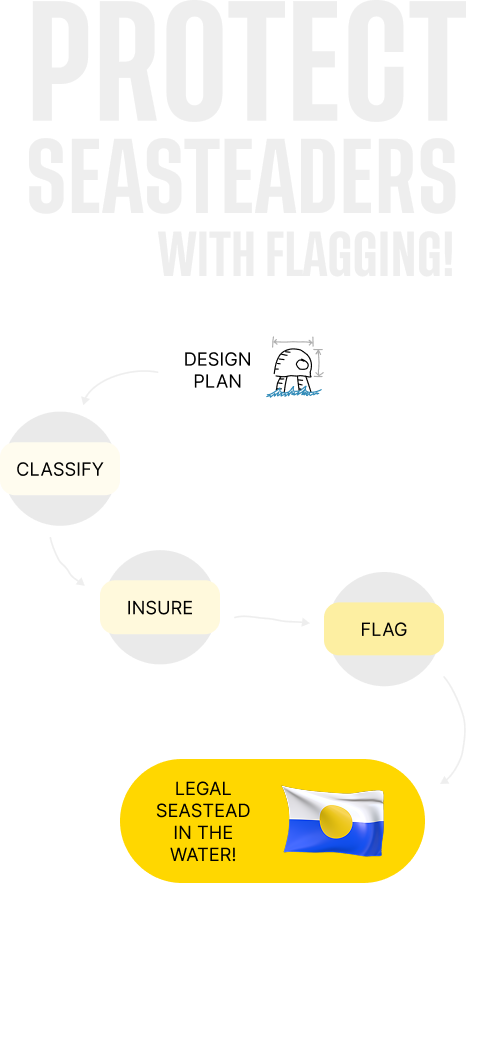

Learn about the revolutionary technology for eco-restorative ocean communities and our plan to secure political autonomy for all seasteaders.

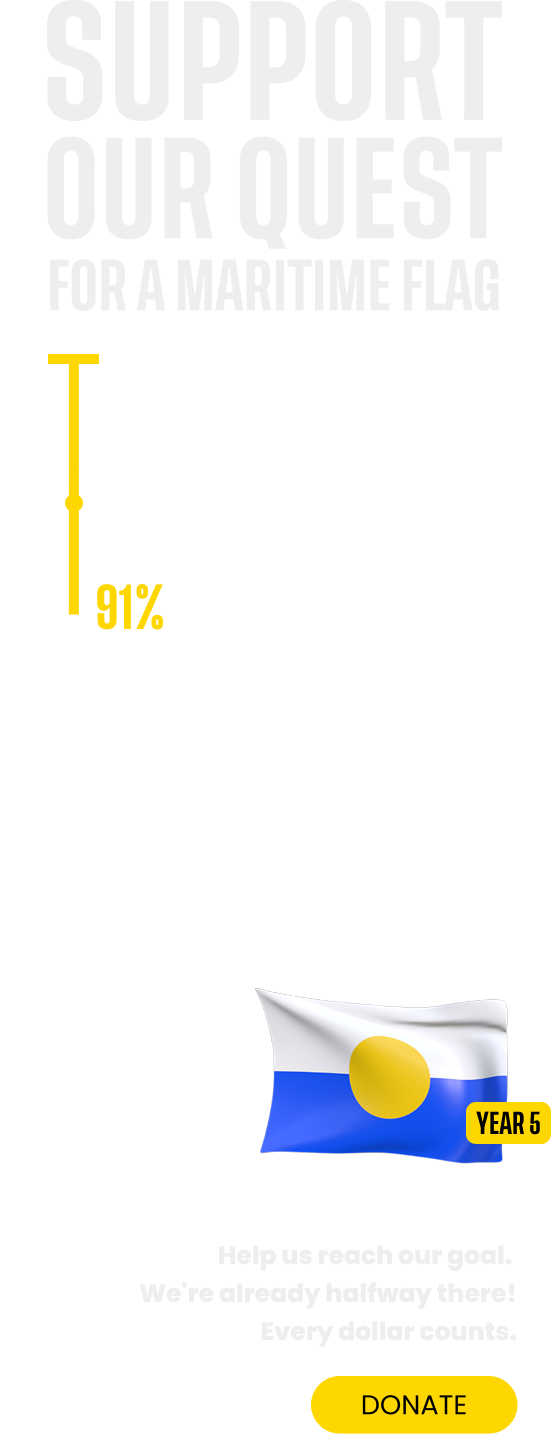

The Seasteading Institute is a nonprofit organization.